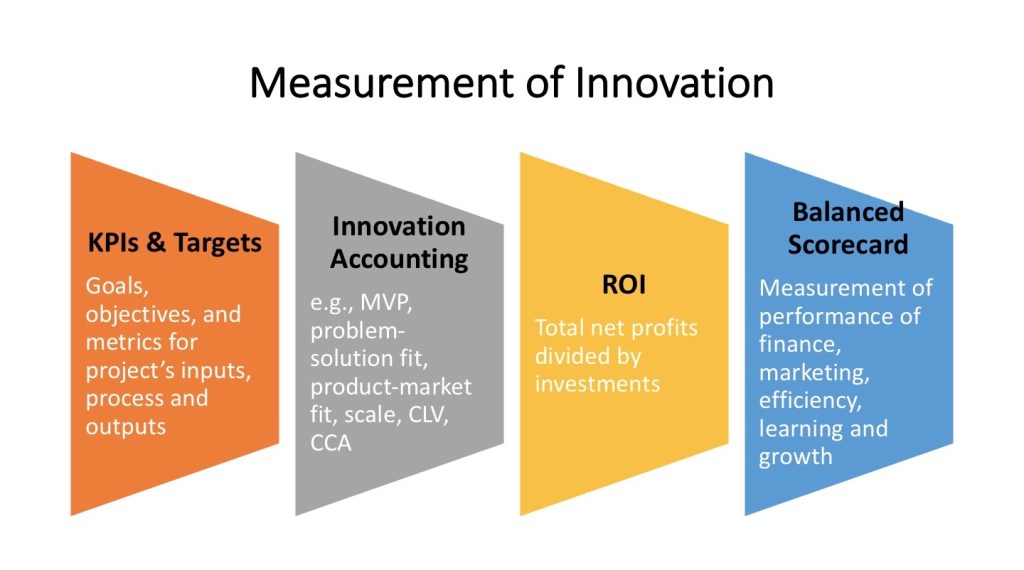

Innovation, like other activities, needs measurement for monitoring and control, but it is never easy to achieve due to qualitative and risk reasons. In this article, I will highlight the four methods to measure innovation: (1) KPIs and metrics, (2) innovation accounting, (3) return on investment, and (4) the balanced scorecard.

Method 1- KPIs and metrics

This method of measuring innovation is illustrated in Andrew’s book ‘Payback’ by setting key performance indicators (KPIs) and metrics for the company’s performances that cover inputs, performance, results, cash payback, and indirect benefits (Andrew and Sirkin, 2006)1:

- Inputs: measuring inputs or resources like money and people enables companies to decide how to allocate them. For example, the project requires a budget of 100 thousand Pound and a team of 10 people.

- Performance: project’s performance metrics may include the Earned Value Management (EVM) (i.e., =% complete (actual) x task budget), Cost Variance (i.e., budgeted cost minuses actual cost), and Schedule Variance (i.e., budget cost of work performed minuses actual cost of work performed).

- Cash payback: management needs to determine whether the innovation process is generating cash payback and for how much. For example, the cash-flow operation generated by an innovation project will be one million Pound a year as a minimum.

- End results: companies use many measures to track their innovation performance. Three of the most popular are the percentage of sales generated by new products (usually defined as less than three years old), the number of patents the company files in a year, and overall revenue growth.

- Indirect benefits: they are, for instance, gained knowledge, brand strength, and organisational confidence and attractiveness. To measure indirect benefits, companies use a variety of metrics like survey instruments of various types, third-party rankings, and cross-company bench-markings that do not produce an absolute value but show trends when administered over time.

Method 2- Innovation Accounting

Eric Ries’s book ‘The lean start-up’ popularises this method, conceptualising the innovation-accounting and measurement (Ries, 2011)2:

Concept of innovation accounting

How do we know that the changes we made are related to the results we see? How do we know we are drawing the right lessons from those changes? To answer these questions, start-ups have a strong need for a new accounting geared specifically to disruptive innovation. That is what innovation accounting is all about. Innovation accounting enables start-ups to prove objectively that they are learning how to grow a sustainable business. Innovation accounting begins by turning the leap-of-faith assumptions (value and growth assumptions). Growth depends primarily on three things: the profitability of each customer, the cost of acquiring new customers, and the repeat purchase rate of existing customers.

How does innovation accounting work?

Innovation accounting works in three steps:

- First- Establish baseline metrics: use a minimum viable product to establish real data on where the company is right now. For example, a start-up might create a complete prototype of its product and offer to sell it to real customers through its primary marketing channel. This single MVP would test most start-up assumptions (e.g., whether customers are interested in buying the product, value acceptance, and growth rate) and establish baseline metrics on value and growth assumptions.

- Second- Tuning the engine: start-ups must attempt to tune the engine from the baseline toward the ideal. Once the baseline is established, the start-up can work toward the second learning milestone: tuning the engine. Every product development, marketing, or other initiative a start-up undertakes should be targeted at improving one driver of its growth model.

- Third- Pivot or preserve: that is the third step: pivot or persevere. Based on the results of building a business model and MVP and measurements learnt from early adopters, you can change assumptions (pivot) or confirm assumptions (persevere).

Method 3- Return on investment (ROI)

ROI is a well-known term and means the project’s net surplus or return (i.e., the project’s total profits minus the investment costs) divided by the investment costs. There are many ways to measure the ROI as the net present value divided by the investment costs. Return on investment is a quantitative method of monetary value to measure the benefits and costs of the project, and a more positive ROI means the project is profitable and favourable for investment. The importance of the ROI results from the critical role this method plays in quantifying the monetary value of the project that most captures stakeholders’ attention. This term is coined to measure innovations by Phillips in the book ‘The Value of Innovation’, introducing the ROI process model for measuring innovations as per the following steps (Phillips, J., and Phillips, P., 2018)3:

- Planning the Evaluation: the first phase of the ROI method is evaluation planning. This phase involves several procedures, including understanding the purpose of the evaluation, confirming the feasibility of the planned approach, planning data collection and analysis, and outlining the details of the project plan.

- Collecting data: is central to the ROI method. Both hard data (representing output, quality, cost, and time) and soft data (including job satisfaction and customer satisfaction) are collected. Data are collected using several methods, including surveys, questionnaires, tests, observations, interviews, focus groups, action plans, performance contracts, or business performance monitoring.

- Isolate the effects of the project: in this step, specific strategies are explored that determine the amount of impact directly related to the project, including control groups, forecasting models, participant estimates, managers’ estimates, experts’ inputs, or customer input.

- Convert data to monetary value: to calculate the return on investment, impact data (e.g., monetary and non-monetary benefits) are converted to monetary values and compared with innovation project costs. Conversion tools include output data, cost of quality, HR time saving, analysis of historic data, participants’ and managers’ estimates, or using the software.

- Identifying intangible benefits: besides tangible or monetary benefits, intangible benefits — those not converted to money — are identified for most projects. Intangible benefits include increased employee engagement, increased brand awareness, improved networking, improved customer service, fewer complaints, or reduced conflict.

- Tabulating project costs: A critical part of the ROI equation is determining the denominator or the total project costs. These costs may include the initial study costs, design and development, project materials, fixed assets, project team, facilities, and overhead costs.

- Calculate return on investment: the net benefits/costs ratio (BCR) is calculated as the project net benefits (after deducting all costs) divided by the project costs. The return on investment (ROI) is the net benefits divided by project costs.

- Reporting: the last step in the ROI model is reporting, which is a critical step and often deficient in attention, and planning is required to ensure its success.

Method 4- The balanced scorecard

The balanced scorecard is a popular method to measure the performance of an organisation based on strategic and business objectives. This approach translates an organisation’s mission and strategy into performance measures that provide the framework for the performance measurement system. Here is a brief description of the balanced scorecard (Kaplan and Norton, 1996)4:

Concept

A balanced scorecard is a tool that guilds companies to measure their performances in four balanced fields: financial, marketing, internal processes, and learning and growing. By this, the balanced scorecard involves measuring the satisfaction levels of the company stakeholders like investors, customers, suppliers, and employees. The way the scorecard system works is that a company first sets its strategic objectives and metrics on finance, sales and marketing, internal efficiency, learning and growth, then monitors and controls its performances in these fields accordingly.

Setting objectives and measure

The balanced scorecard comprises objectives and measurements on:

- Vision and strategy: where you can identify the company’s objectives, initiatives, targets, KPIs and measurements.

- Financial: For a company to succeed financially, how should it appear to its shareholders? Financial objectives typically relate to profitability measured, for example, by operating income, return-on-capital employed, economic value-added, sales growth or generation of cash flow.

- Customer: a company to achieve our vision, how does it appear to its customers? Managers identify the customer and market segments in which the business will compete and the measures of the business performance in these targeted segments. Marketing objectives can be, for instance, sales, growth of sales, market share, customer development, customer acquisition cost, or customer lifecycle value. The measures derived from objectives can include customer satisfaction, customer retention, new customer acquisition, customer profitability, market share in targeted segments, or value propositions.

- Internal business process: to satisfy shareholders and customers, what business processes must excel at? These processes enable the business unit to deliver the value propositions that will attract and retain customers in targeted markets and satisfy shareholder expectations of excellent financial returns. Internal processes include, for instance, customer needs identification, operation, quality control, supply chain management, distribution, innovation, post-sale services, customer-need satisfaction, etc. Measures can include efficiency of production, productivity, quality, response time, cost of products, and new product development.

- Learning and growth: for a company to achieve its vision, how shall it sustain its ability to change and improve? Organisational learning and growth result from three principal sources: people, systems, and procedures. Financial, customer, and internal-business-process objectives are inadequate; thus, a company must add learning and growth objectives to achieve breakthrough performance. Businesses to be successful, they must invest in learning and growth objectives like reskilling employees, enhancing information technology and systems, and aligning organisational procedures and routines. Measures include employee satisfaction, productivity, training, staff turnover, and operating system availability.

- This post is sourced from my new book- Your Guide To Reach Innovation.

- For more information about the book: https://growenterprise.co.uk/your-guide-to-reach-innovation/

- To register in our newsletter: http://eepurl.com/ggcC29

Final note: the book- Your Guide To Reach Innovation, is an actionable guide to innovation from beginning to end. Enjoy reading the book, and I look forward to your reviews.

Author: Munther Al Dawood

maldawood@growenterprise.co.uk

References:

- Andrew, J. and Sirkin, H., 2006. Payback, Harvard Business School Press, Boston Massachusetts.

- Ries, E., 2011. The lean start-up, Crown Business New York.

- Phillips, J., and Phillips, P., 2018. The value of innovation, Wiley, NJ USA.

- Kaplan, R. and Norton, D., 1996. Balanced Scorecard, Harvard College, Boston Massachusetts.