A business model is a tool showing how a firm creates, delivers, and captures value. Not all business models are the same, and models depend on the comprehension and the level of progress a business concept is through. In this article, I outline the business model concept, types of models, and criteria for assessing a business model innovation.

What is the business-model innovation?

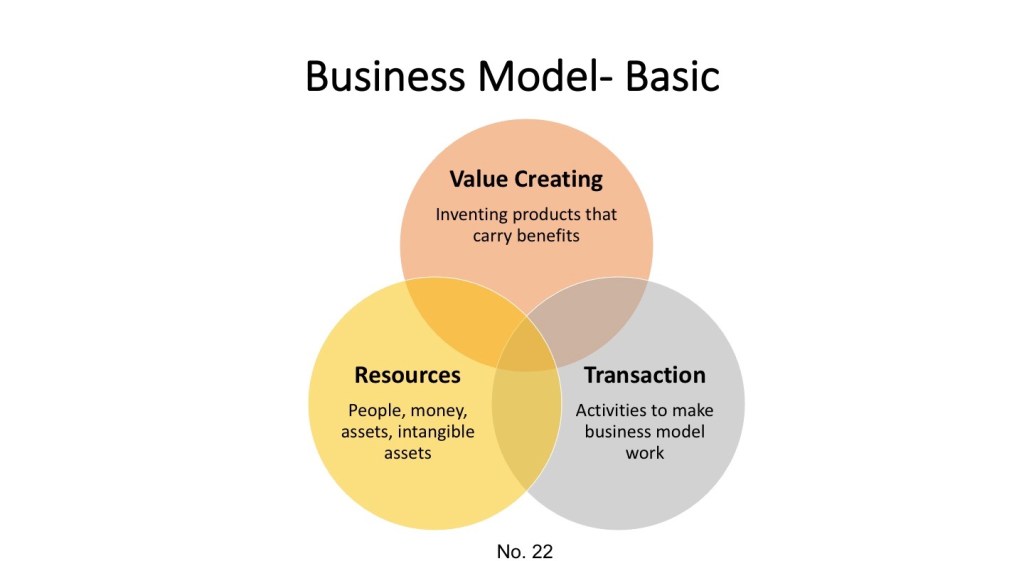

The business model explains how a firm creates, delivers, and captures values. How do we judge the significance of any value? A group of customers decides the significance of values by accepting or rejecting them. Values are benefits and features that a product or service carries. Business model innovation shows how businesses invent value propositions that customers want. Any business model typically identifies three business elements:

- Value creation: identifies the new benefits and features that products or services carry around, for instance, the capacity, speed, battery duration, size, and weight of a laptop.

- Transaction: determines activities to create, deliver and capture values like producing, distributing and selling new products.

- Resources: define physical and non-physical assets required to perform activities like human staff, monies, machinery, offices, know-how, or IP.

Business-model innovation varies in terms of comprehension depending on the start-up level of progress. The business model applicable for a pre-start-up (looking for the problem-solution fit) is a basic model developed by Block and George’s book ‘The business model’ as explained above. For start-ups, looking for product-market fit, Ash Maurya designed the matching business model in his book ‘Running lean’. Last, for businesses looking to scale up, the business model- Canvas developed by Osterwalder and Pigneur in their book ‘Business model generation’ is the best fit.

Business model- For pre-start-ups

This business model is basic and suitable for pre-start-ups searching for the best business concept. It comprises the following structure (Block and George, 2017)1:

- Resources: are tangible and intangible assets necessary to run a business. Resources may include physical assets (e.g., machinery, furniture, or offices), human resources (e.g., management and employees), capital (i.e., monies), and unphysical assets (e.g., know-how, patent, trademark, intellectual rights, good-well, reputation, or experiences). Any resource worthiness can be evaluated using the SHaRP tool (i.e., standing for Specialisation, Hard to Copy, Rare and Precious). According to SHaRP, assets can be value advantages for the company if they come with a high level of specialisation, are hard to copy, rare and difficult to find, and valuable or beneficial.

- Transactions: are activities necessary to create, deliver and capture values and include appointing staff, production, managing financials, storing, selling, and networking. Start-ups take key actions necessary to innovate values; thus, it only chooses processes that add value to the business and eliminate waste.

- Value creation: is about creating new solutions or products that customers want. Creating value involves observing people, understanding and identifying problems, developing solutions and prototypes, experimenting, and implementing. Not only do start-ups create value, but they also capture them by selling and monetising values.

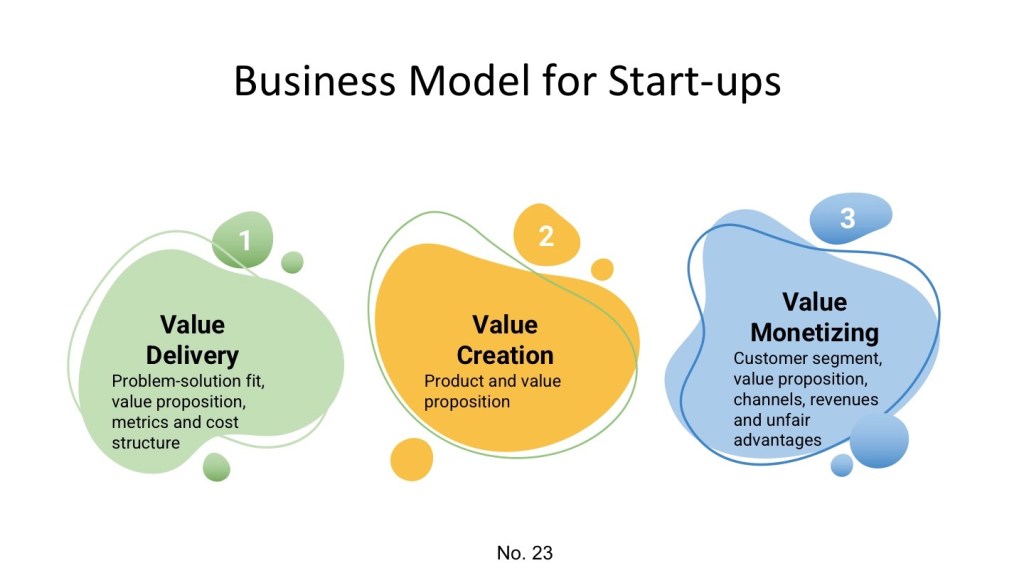

Business model- For start-ups

This business model is designed for start-ups searching for the product-market fit and comprises three sets of activities to create, deliver, and capture values. The following is a brief description of this business model (Ash, 2012)2:

- Deliver value (or product development): comprises activities like identification of the problem, solution, the key metrics to measure the activities, cost structure, and the unique value proposition.

- Create value: comprises activities to design and identify the value proposition of a new business, which explains why your business differs from other competitors and is worth buying its products or services.

- Monetise value (Market development): comprises the details related to selling and capturing values such as identification of the target customer segments, unique value proposition, channels (i.e., the path to customers), unfair advantage (i.e., how the new business and offer are protected), and revenue streams (e.g., revenue model, lifetime value, revenue targets, or gross margin).

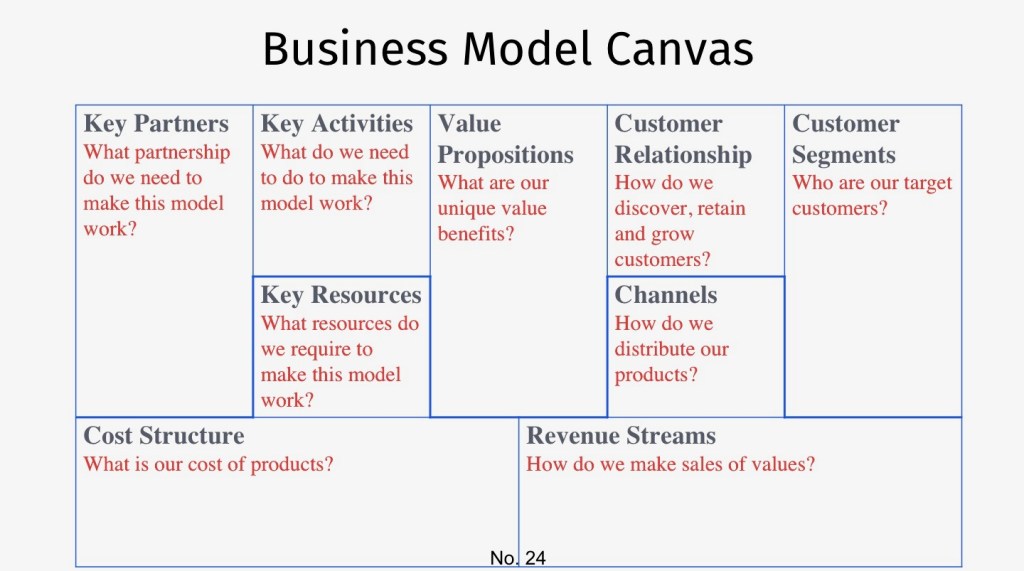

Business model- Canvas

When start-ups have achieved problem-solution and product-market fit, they will be ready to draw the business model canvas showing their growth paths forward. The business model canvas is a fantastic tool for torching start-ups to grow business and comprises nine business blocks (Osterwalder and Pigneur, 2010)3:

- Customer segments: define people and organisations an enterprise aims to reach and serve. To better satisfy customer needs, a company breaks them down into segments, which share similar needs, value perceptions, behaviours, interests, incentives, and fears.

- Value propositions: describe the bundle of products and services that create value for the customer segments. Value propositions are unique benefits that a company offers customer segments. The values may be quantitative (e.g., price, speed of service, or channels) or qualitative (e.g., easy to access, simple to use, design, or customer experience). A value proposition is worthy if it is significantly new, valuable, speciality, hard to copy and imitate, rare, and precious. Examples of value propositions are performance improvement, design enhancement, unique features, function, customised to customer needs, reduced cost, convenience, and the like.

- Channels: describe how a company communicates with and reaches its customer segments to deliver value propositions. Channels can be direct (e.g., sales forces, web sales, or own outlets) or indirect (e.g., partnerships, distributors, agents or wholesalers and retailers).

- Customer relationships: describe the relationships a company establishes with specific customer segments to make a business model work. Customer relationships may be driven by various motivations like customer acquisition, retention, growing, or boosting sales.

- Revenue streams: represent the cash (sales or income) a company generates from each customer segment. Revenues are a key to making net earnings (i.e., revenues minus costs). Each revenue stream may have different pricing mechanisms, such as fixed list prices, bargaining, auctioning, market dependent, volume dependent, or yield management. They can be transaction revenues (i.e., resulting from one-time customer payments) or recurring revenues (i.e., are when resulting from ongoing deals). There are several ways to generate revenue streams: asset sales, usage fees, subscription fees, renting, licensing, or advertising.

- Key resources: describe the most important assets required to make a business model work. Resources can be physical (e.g., machinery or offices), financial (e.g., money or funds, capital, loan or grants), intellectual (e.g., non-physical assets, IPO, copyright, logo, know-how, customer database), or human (e.g., skilful staff and management).

- Key activities: describe the most favourable activities a company must do to make its business model work. They can be the production of values, supply chain management, acquiring resources, reaching markets, maintaining customer relationships, or earning revenues.

- Key partnerships: describe the network of suppliers and partners that make the business model work, reduce risk, or gain resources. Partnerships may be formal (e.g., a strategic alliance agreement or a contract with supplier chains) or informal (e.g., a group of professionals on social media).

- Cost structure: describe all costs required to operate a business model. Cost structures can be fixed like office rent (i.e., when they remain unchanged despite the production change) or variable, like the cost of materials (i.e., when expenses change due to production levels). In turn, costs are operating expenditures companies bear to get services or materials necessary to achieve missions and plans.

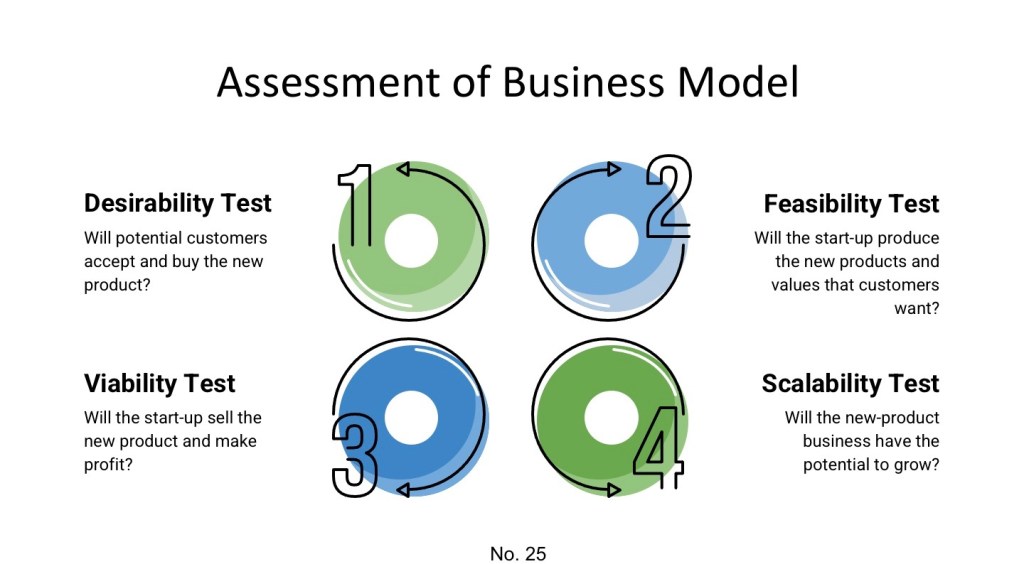

Assessment of business model

There are no specific criteria that you can use to assess the effectiveness and reliability of your business model; besides, I believe that the best business model achieves the highest levels of desirability, feasibility, viability and scalability. Thus, I list below the criteria for your guidance to judge the desirability, feasibility, viability, and scalability levels of your business model:

Desirability test (Market test)

- Value propositions: can your business model make a solution product or service that carries new, valuable, speciality, difficult-to-copy and imitate, rare, and precious value propositions?

- Creating a market: can your business model create a new market and secure a sufficient demand for your new products?

- Competition: How does the business model strengthen your positioning and competition? Does your business model increase the edge of your business over competitors?

- Customer development: how will your business model gain, retain and grow customers?

- Channels: does your business model invent new channels to deliver and capture values?

- Others: how does your business model get customers or third parties to create value for you for free?

Feasibility test (Technical test)

- Value creation: how possible can your business model create values and quality control? How likely can your business model make sellable products that carry these value propositions?

- Team or technology-intensive (resources): is your business model a technology-intensive model? Does it require special talent skills? How easy can you get sufficient funds for your business?

- Waste control: can your business model contribute into wastes elimination?

- Partnership: does your business model create new ways to partner with supply chains that support the operation of the business?

- Activities: does your business model invent activities to reduce cost, increase quality, reduce waste, and reduce lead time to the market?

- Protection: How does your business model protect your unfair advantages from copying and imitating from competitors?

Viability test (Profitability test)

- Profitability: can your business model support profitability?

- Sustainability: does your business model contribute to social support and environmental protection?

- Switching costs: how easy or difficult is it for customers to switch to another company?

- Recurring revenues: is every sale a new effort needed to make and follow up?

- Earnings vs spending: are you earning revenues before you incur costs?

- Cost structure: is your cost structure substantially different, better, and more supportive than your competitors?

Scalability test (Growing test)

- Potential scalability: how does your business model support the growth of your business?

- Grow customers: does your business model have strong attractions to grow customers?

- Growth facilities: how easily can you grow without facing roadblocks (e.g., assets, infrastructure, customer support, hiring)?

- This post is sourced from my new book- Your Guide To Reach Innovation.

- For more information about the book: https://growenterprise.co.uk/your-guide-to-reach-innovation/

- To register in our newsletter: http://eepurl.com/ggcC29

Final note: the book- Your Guide To Reach Innovation, is an actionable guide to innovation from beginning to end. Enjoy reading the book, and I look forward to your reviews.

Author: Munther Al Dawood

maldawood@growenterprise.co.uk

References:

- Block, A. & George G. 2017. The business model.

- Maurya, Ash, 2012. Running lean, 2nd edition, O’Reilly, USA

- Osterwalder, A. and Pigneur, Y., 2010. Business model generation, John Wiley & Sons, New Jersey.