Concept

The blue ocean approach divides any market into two streams: red and blue oceans. Read oceans represents all the industries in existence and share common characteristics like a known market space, industry boundaries are defined and accepted; and the competitive rules of the game are known. Here, companies usually outperform their rivals to capture the highest share of existing demand. While blue oceans denote all the industries not in existence today, and this is the unknown market space. Blue oceans are untapped market spaces, demand creation, and opportunities for profitable growth. Most blue oceans are created from within red oceans by expanding existing industry boundaries. In blue oceans, competition is irrelevant because the game rules are unset yet. Seizing new profit and growth opportunities will need to create a blue ocean strategy (Chan Kim and Mauborgne, 2005)1.

Background

The blue ocean approach was first introduced by Chan Kim and Mauborgne in the book ‘Blue ocean strategy’ in 2005. This book introduced a theory on how to create uncontested market space and make the competition irrelevant. This approach followed a different strategic logic than the competitive market, the value innovation path (or blue oceans) that occurs when companies align innovation in higher utility or value proposition, lower price, and cost positions.

How does it work?

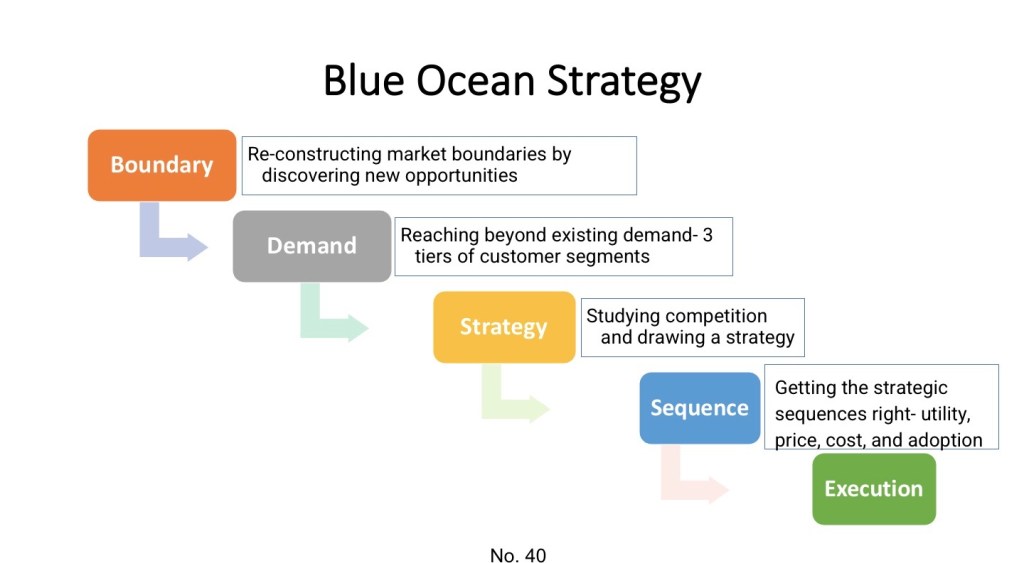

Here is a brief description of the steps to create a blue ocean strategy (Chan Kim and Mauborgne, 2005)2:

Action (1): Reconstruct market boundaries

- Path 1: Look across alternative industries: alternatives include products or services that have different functions and forms but have the same purpose. For example, by sorting out finances, people can buy and install a financial software package, hire a CPA, or use pencil and paper. Consider cinemas versus restaurants. The space between alternative industries provides opportunities for value innovation.

- Path 2: Look across strategic groups within industries: the term refers to a group of companies within an industry that pursue a similar strategy. Strategic groups can be ranked on many dimensions like price and performance. Most companies focus on improving their competitive position within a strategic group. For example, Mercedes, BMW, and Jaguar focus on out-competing one another in the luxury car segment as economy car makers focus on excelling over one another in their strategic group. Neither strategic group pays much heed to what the other is doing because they do not seem to compete. The key to creating a blue ocean across existing strategic groups is to break out of this narrow tunnel vision by understanding which factors determine customers’ decisions to trade up or down from one group to another.

- Path 3: Look across the chain of buyers: the purchasers who pay for the product or service may differ from the actual users, and sometimes, there are important influencers as well. Although these three groups may overlap, they often differ. When they do, they frequently hold different definitions of value. By looking across buyer groups, companies can gain new insights into how to redesign their value curves to focus on a previously overlooked set of buyers.

- Path 4: Look across complementary product and service offerings: take, for instance, movie theatres, the ease and cost of getting a babysitter and parking the car affect the perceived value of going to the movies. Yet, these complementary services are beyond the boundaries of the movie theatre industry, as it has been traditionally defined. Few cinema operators worry about how hard or costly it is for people to get babysitters. But they should, because it affects demand for their business. Untapped value hides in complementary products and services. The key is to define the total solution buyers seek when they choose a product or service.

- Path 5: Look across functional or emotional appeal to buyers: some industries compete principally on price and utility; their appeal is rational. Other industries compete in feelings; their appeal is emotional. When companies challenge the functional-emotional orientation of their industry, they often find new market space.

- Path 6: Look across time: industries are subject to external trends that affect their businesses overtimes. Think of the rapid rise of the Internet or the global movement toward protecting the environment. Looking at these trends with the right perspective can show you how to create blue ocean opportunities. By looking across time—from the value a market delivers today to the value it might deliver tomorrow — managers can actively shape their future and lay claim to a new blue ocean. We’re not talking about predicting the future, something that is inherently impossible. Rather, we’re talking about finding insight into trends that are observable today.

Action (2): Draw your strategy canvas

- Review the existing strategy canvas: involves reviewing competitors’ value offering based on value-factor criteria, which comprise two axes, the vertical one for the low-high gage, and the horizontal axis defines the value factors (e.g., price, quality, utilities, channels, etc), and accordingly competitors are listed in this chart enabling comparison and rethinking of futuristic opportunities.

- Drawing your strategy canvas: you can get further details on constructing the business model Canvas, which is illustrated in this book.

- Reviewing discovery: compare your business with competitors and discover where your strategy needs to change.

- Creating values: go into the field to explore paths to creating blue oceans. Observe the value advantages of alternative products and services. See which factors you should eliminate, create, or change.

- Visualise strategy: draw your “to be” strategy canvas based on insights from field observations. Get feedback on alternative strategy canvases from customers, competitors’ customers, and noncustomers. Use feedback to build the best “to be” future strategy.

- Communication and implementation: distribute your strategy as on one-page document for easy comparison. Support only those projects and operational moves that allow your company to close the gaps to actualise the new strategy.

Action (3): Reach beyond existing demand

To reach beyond existing demand, you think of noncustomers before customers, commonalities before differences, and de-segmentation before pursuing segmentation. The three tiers of noncustomers include:

- The first tier of noncustomers: is closest to your market. They sit on the edge of the market. They are buyers who minimally purchase an industry’s offering out of necessity but are mentally noncustomers of the industry. In the fast-food industry, for instance, these first-tier noncustomers are always searching for better solutions, although there are many differences across them. However, they share three key commonalities: (1) they want lunch fast, (2) fresh and healthy, and (3) at a reasonable price.

- The second tier of noncustomers: is people who refuse to use your industry’s offerings. Consider how JCDecaux, a vendor of French outdoor advertising space, pulled the mass of refusing noncustomers into its market. Outdoor advertising was not a popular campaign medium for many companies because it was viewed only in a transitory way. In searching for a solution, JCDecaux found municipalities could offer stationary downtown locations, such as bus stops, where people waited a few minutes and hence had time to read and be influenced by advertisements. JCDecaux reasoned that if it could secure these locations to use for outdoor advertising, it could convert second-tier noncustomers into customers.

- The third tier of noncustomers: is farthest from your market. They are noncustomers who have never thought of your market’s offerings as an option. Just think of the long-held assumption that tooth whitening was a service provided only by dentists and not by oral care consumer-product companies, which until recently never looked at the needs of these noncustomers. When they did, they found an ocean of latent demand waiting to be tapped and also found that they could deliver safe, high-quality, low-cost tooth whitening solutions, and the market exploded.

Action (4): Get the strategic sequence right

Companies need to build their blue ocean strategy in the sequence of buyer utility, price, cost, and adoption.

- Buyer utility– value proposition (revenue side): is there exceptional buyer utility in your business idea? Does your offering unlock exceptional utility? Is there a compelling reason for the mass of people to buy it? If yes, then you move to the second sequence- the price.

- Price (revenue side): is your price easily accessible to the mass of buyers? Is your offering prices attracting the mass of target buyers to pay for it?

- Cost (profit side): can you attain your cost target to profit at your strategic price? Can you produce your offering at the target cost and still earn a healthy profit margin? Can you profit at the strategic price—the price easily accessible to the mass of target buyers?

- Adoption (distribution channels, customer relationships, partnership, activities, resources): what are the adoption hurdles in actualising your business idea? Are you addressing them up front? Adoption hurdles include, for example, potential resistance to the idea by buyers, users, distributors or partners.

- Result: based on the above investigation of the business elements, develop a commercially viable blue ocean concept.

Action (5): Overcome the key organisational hurdles

Once a company has developed a blue ocean strategy with a profitable business model, it must execute it. The challenge of strategy execution always exists and can be summarized as per the following four hurdles:

- One is cognitive: changing the mindset and beliefs of employees that the way forward to profitability is not through a red ocean but a blue ocean strategy.

- The second hurdle is limited resources. The greater the shift in strategic thinking and doing, the greater the resources needed to execute it. An insufficient resource is a big hurdle to the execution of any project.

- The third is motivation. How do you motivate the key players to move fast and break the status quo? That will take years, and managers usually do not have the time to handle it.

- The last hurdle is politics. It is about selling your ideas internally and externally while dealing with others’ agendas.

Action (6): Build Execution into Strategy

To build people’s trust and commitment deep in the strategy and inspire their cooperation, companies build execution into strategy from the start. That principle allows companies to minimise the management risk of distrust, non-cooperation, and even sabotage. Companies must reach fair processes in the making and execution of strategy. Here are some examples of executing processes:

- The fair strategy formulation process encompasses engagement, explanation and expectation clarity.

- Fair process results in trust and commitment from employees, “I feel my opinion counts”.

- Trust and commitment of employees result in voluntary cooperation or behaviour “I’ll go beyond the call of duty”.

- This post is sourced from my new book- Your Guide To Reach Innovation.

- For more information about the book: https://growenterprise.co.uk/your-guide-to-reach-innovation/

- To register in our newsletter: http://eepurl.com/ggcC29

Final note: the book- Your Guide To Reach Innovation, is an actionable guide to innovation from beginning to end. Enjoy reading the book, and I look forward to your reviews.

Author: Munther Al Dawood

maldawood@growenterprise.co.uk

References:

- Chan Kim, W., and Mauborgne, R., 2005. Blue ocean strategy, Harvard business school press, Boston, Massachusetts.

- Chan Kim, W., and Mauborgne, R., 2005. Blue ocean strategy, Harvard business school press, Boston, Massachusetts.